If you don’t already know, becoming a shareholder of a company used to be a very difficult process. Times have changed, and it’s now easy to become a shareholder in pretty much any company you want.

In fact, it can be so simple to invest in a company that you don’t need to know much about the stock market.

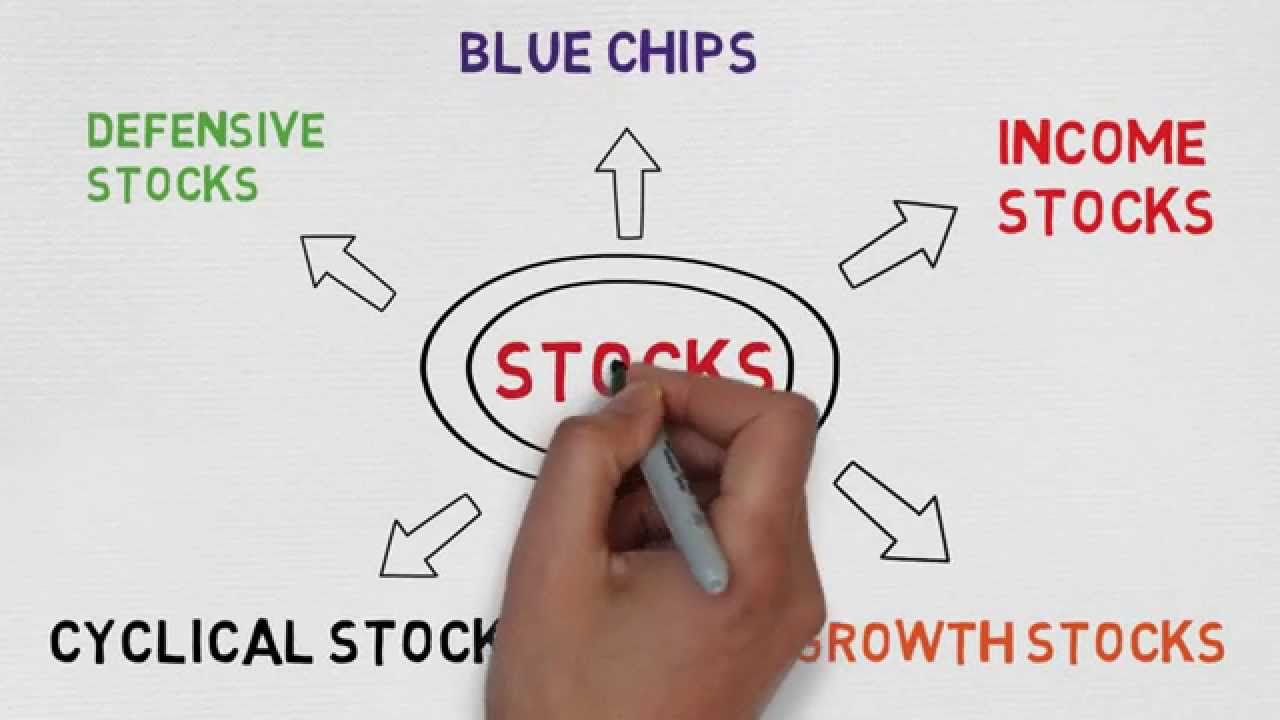

Still, investing in stocks is a great way to grow your money and have more assets available to you throughout life, so it helps to know a little bit about the different types of stocks and the stock market.

Read on!

Contents

Income Stocks

Income stocks, which are also known as “dividend stocks,” are types of stocks that pay regular dividend payments. These dividends are usually paid out on a quarterly or semi-annual basis. The investors receive their income from the cash dividends that are paid out rather than gains from stock price appreciation.

Dividends represent a portion of a company’s profits, distributed to shareholders. Income stocks are often a safe and steady choice for investors looking for a steady income stream from their stock investments.

They also provide a cushion against market volatility, making them a popular choice for retired investors and those looking to supplement their income streams.

Common and Preferred Stocks

Common stock represents ownership in the company. It entitles the holder to vote in shareholder meetings and receive dividends. Preferred stock generally pays out a fixed dividend and has no voting rights.

Common stock owners also have the right to receive any remaining assets after the liquidation of the company. Preferred stockholders, however, generally receive their full amount even if the company were to be liquidated. Preferred stocks also often have a longer lifespan, and holders may not sell their holdings at any particular time.

Blue-Chip Stocks

Blue Chip stocks are a type of stock that represent large, well-known high-quality companies. They are highly sought-after stocks due to their steady performance and relative predictability.

Not only do they offer regular returns on investments, but also generate significant profit for smart investors when the market rises. Furthermore, these stocks tend to be more resilient during times of economic upheaval. Investors view them as safe investments.

To be able to invest in these stocks you must find a good online stocks broker. You can check out RoboMarkets and apply your investing strategy.

ESG Stocks

ESG stocks are securities linked to companies or funds that perform environmentally friendly, socially responsible, and corporate governance activities. They show a commitment to sustainability and the implementation of ethical and social policies.

Two types of ESG stocks include those for companies that support renewable energy, sustainable food production, and organic farming. Also, they are those that represent asset classes. These are socially responsible investments, such as ESG funds, green and impact funds, and socially responsible ETFs.

ESG stocks provide investors with a way to express their commitment to positive social and environmental impacts while earning a return on their money.

These stocks can be used for diversifying a portfolio and help reduce risk by investing in companies that have solid business fundamentals. They also emphasize transparency and justice.

Growth Stocks

Growth stocks involve investing in companies that consistently report strong financial performance. They have considerable potential for future growth.

One of the attractions of growth stocks is that investors don’t rely so much on the usual performance of a company’s stock. The increase in share price occurs over a longer term period.

Additionally, these companies reinvest their profits back into the company to fuel further growth. Growth stocks have an appealing risk/reward ratio for investors who are willing to take a chance on the long-term potential.

Value Stocks

Value stocks are a type of stock that is usually bought by investors with a long-term vision. These stocks are judged to be undervalued compared to their peers. They can be compared to ‘bargains’ or stocks that are trading at less than their intrinsic value. This might be based on earnings, book value, dividends, sales, and other metrics.

Also, value stocks are often found in mature industries, where expectations of growth are dim. They are usually from companies that have strong fundamentals. Usually, they have low debt and a high return on equity.

Value stocks may have slower growth potential but also present a lower risk of investment than growth stocks. These stocks often pay dividends and have higher yields. They are an attractive option for income investors.

IPO Stocks

IPO stocks, or initial public offering stocks, are stocks that a company decides to initially offer its shares of to the public. This type of stock is generally the most attractive to stock investors. This is because the work and progress of the company were invested in before the offering was made public.

Companies are usually very well established prior to the public offering of their stock. It means that investors have access to some valuable information they can use to help make an informed investment decision.

Companies must consider how to price their IPO stock. This is for them to maximize their audience and their profits. They also need to think about how the stock will fit in their existing market.

Penny Stocks

Penny stocks come in many different varieties and have various purposes. Generally speaking, they are stocks that trade for less than one dollar. They are very low in price when compared to traditional stocks. These stocks can be found on both the NYSE and NASDAQ.

In terms of types, penny stocks are categorized as small-cap stocks, speculative stocks, and pumped and dumped stocks. Small-cap stocks are the most common type of penny stock and provide greater liquidity and possibly higher gains.

Speculative penny stocks are riskier, as these companies are only making promises with no proof of actually delivering those promises.

Make the Right Investment by Knowing the Different Types of Stocks

When it comes to stock investments, there are different types of stocks that you will be able to find out there. It is very important that you choose properly the stocks to invest in. Each of these stock options has its own advantages and risks, so it is important to understand each type thoroughly before investing.

There are investing trends that you can follow to be profitable. However, you need to do your own research and not just follow other traders or investors.

For more tips, be sure to check out more of our posts.