Harshad-mehta-bull-run rajkotupdates.news : The Indian stock market has seen its fair share of ups and downs, but none quite as scandalous as the Harshad Mehta bull run of the early 1990s. Harshad Mehta, a stockbroker from Mumbai, manipulated the stock market to unprecedented heights, only to watch it all come crashing down in one of the biggest scams in Indian history.

Contents

Who is Harshad Mehta?

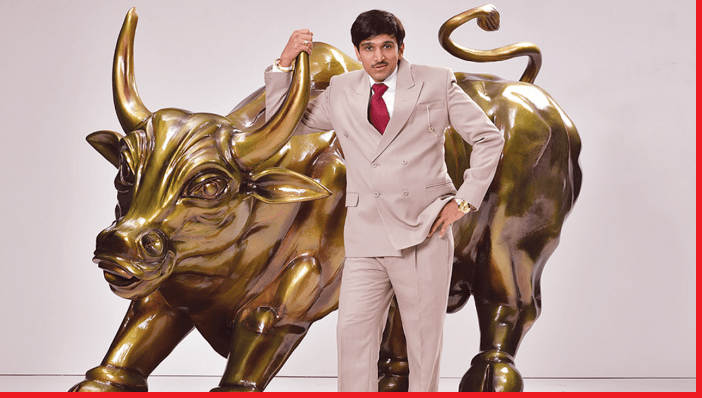

Harshad Mehta was an Indian stockbroker and businessman who was convicted for committing securities fraud in 1992. He was known for his involvement in a stock market manipulation scheme, which involved illegally borrowing money from banks and investing the funds in the stock market. Mehta’s actions led to a significant rise in the Bombay Stock Exchange, but eventually resulted in a crash and the loss of billions of dollars for investors. Mehta died in 2001 while serving a prison sentence for his role in the scandal.

The Harshad-mehta-bull-run rajkotupdates.news Scam: Consequences and Lessons Learned

The Rise of Harshad Mehta

Harshad Mehta started his career in the stock market in the late 1970s, as a small-time broker in Mumbai. However, it was during the early 1990s that he made his mark on the Indian stock market. He exploited a loophole in the banking system, known as the ‘Ready Forward’ deal, to borrow money from banks and use it to invest in the stock market. He used this money to buy large quantities of shares in various companies, driving up their prices and creating a bull run in the stock market. At one point, the stock market index, Sensex, rose from 1,194 points in March 1991 to an all-time high of 4,467 points in April 1992.

The Fall of Harshad Mehta

The Harshad Mehta bull run was short-lived. The Reserve Bank of India (RBI) caught on to his fraudulent practices and started investigating him. It was found that he had siphoned off money from banks and manipulated the stock market to his advantage. The RBI cracked down on him and banned him from trading in the stock market. This led to a panic sell-off in the market, and the Sensex crashed by over 50% in just a few months.

The Aftermath

The Harshad Mehta scam exposed the loopholes in the Indian banking system and led to a series of reforms in the stock market. The Securities and Exchange Board of India (SEBI) was set up to regulate the stock market, and the RBI tightened its rules around bank lending. The scam also led to the arrest of Harshad Mehta and several others involved in the fraud.

FAQ: Harshad-mehta-bull-run rajkotupdates.news

Q: What is the Harshad Mehta Bull Run?

A: The Harshad Mehta Bull Run was a period of time in the Indian stock market during the early 1990s when stock prices rose dramatically, largely due to the actions of stockbroker Harshad Mehta.

Q: Who was Harshad Mehta?

A: Harshad Mehta was a stockbroker who became famous for his involvement in the Indian securities scam of 1992. He was known as the “Big Bull” and was responsible for the rise in stock prices during the Harshad Mehta Bull Run.

Q: What caused the Harshad Mehta Bull Run?

A: The Harshad Mehta Bull Run was caused by a number of factors, including a lack of regulation in the Indian stock market, the availability of easy credit, and the actions of stockbrokers like Harshad Mehta.

Q: What was the impact of the Harshad Mehta Bull Run?

A: The impact of the Harshad Mehta Bull Run was significant, as it led to a major stock market crash in 1992. Many investors lost their life savings, and the Indian government was forced to take action to regulate the stock market and prevent similar events from occurring in the future.

Q: Where can I find more information about the Harshad Mehta Bull Run?

A: You can find more information about the Harshad Mehta Bull / Harshad-mehta-bull-run rajkotupdates.news Run online, through news articles, and from books about the Indian stock market and the securities scam of 1992. Rajkotupdates.News may also have articles about this topic.

Conclusion

The Harshad Mehta bull run was a dark period in Indian stock market history. It exposed the flaws in the banking system and led to the downfall of one of the most notorious stockbrokers in the country. However, it also led to much-needed reforms in the stock market and paved the way for a more transparent and regulated system. It serves as a reminder that even the biggest bull runs can come crashing down, and that investors should always be cautious and vigilant when investing in the stock market.