NRO Fixed Deposit – 6 Things to Keep in Mind: As per the report released by SEBI, more than 95% Indians prefer to park their money in fixed deposits in comparison to investment in mutual funds or stocks.

Fixed deposit proves to be a safer option among other forms of deposits, which brings forth higher returns while posing minimal risks. They assure the investor with a fixed rate of interest.

Management of finances both in India and abroad turns out to be much more challenging for the NRIs. In consideration of this situation, the Foreign Exchange Management Act (FEMA) has laid out rules for NRIs, which includes the conversion of their savings to Non-Resident Ordinary (NRO) account for convenient management of funds generated in India.

An NRO fixed deposit account is retained by a non-residential Indian to deposit and manage their income earned in India in a hassle-free manner. This type of fixed deposit is subjected to taxation as per Indian laws. NRO offers a host of advantages for the NRIs; however, before availing investment benefits from NRO, certain things should be taken into consideration.

Contents

6 factors to keep in mind – NRO fixed deposit rate

1.Deposit and withdrawal

NRO deposits are strictly restricted to income generated in India. NRIs are prohibited to start a fixed deposit from their earnings abroad. Withdrawal, as well as deposit of funds, can only be done in Indian currency. NRIs cannot avail loan from this account.

2.Payment options

Payments are only accepted via RTGS/NEFT or cheque from the NRO account. Any other mode of payment such as through debit card, demand draft, UPI or IMPS is not acceptable for the fixed deposit account of NRO.

3.Interest rate

An NRI must consider the interest rates offered by the financial institution before opting to open their NRO account. They must compare the options and invest in a fixed deposit that offers higher returns.

Some of the renowned financial institutions offer their FDs to NRIs for tenors ranging between 12 and 36 months. Also, an investor can maximise his/her wealth generation opportunity by investing for a tenor of up to 36 months.

Further, they can opt for maturity or periodic payouts of invested fixed deposit amount through either of the following ways.

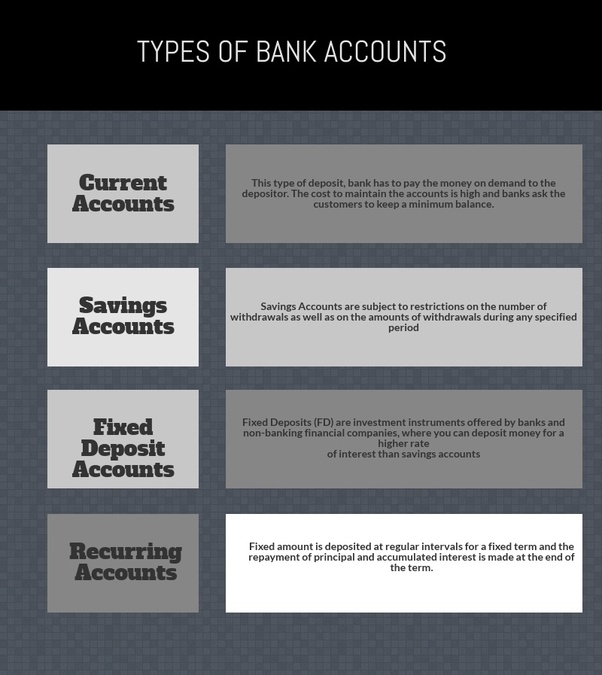

4.Type of account

- Cumulative FD – With the highest interest rate of up to 8.10% in the case of new customers, cumulative FD for NRIs allow withdrawal at the time of maturity.

- Non-cumulative FD – Investors can opt to receive periodic payouts on NRI FDs basis monthly, quarterly, semi-annually and annually in the case of non-cumulative FD.

They must, however, select the financial institution carefully to enjoy these benefits. For example, NBFCs like Bajaj Finance bring assured returns with such attractive interest rates on Fixed Deposit for NRIs.

5.Taxation

Tax should be paid according to the income tax slab of India. If the annual income from deposits is less than Rs. 50 Lakh, tax deduction will be at a rate of 31.2%.

In case it is more than Rs. 50 Lakh, but less than Rs. 1 Crore, the interest rate will be 34.2%. Subsequently, the annual interest on deposits of more than Rs. 1 Crore will be 35.88%.

Nevertheless, NRIs can also claim tax benefits on NRO deposits, including invested FD amount, under the Double Tax Avoidance Agreement (DTAA).

6.Joint account

NRO fixed deposit allows the non-resident Indians to open a joint account with an Indian citizen residing in India. The account can also be jointly held on a former or survivor basis. In case the former expires, the survivor receives sole entitlement to the account.

Benefits of NRO accounts

If the individual opts for NRO fixed deposit, he/she will enjoy the following features-

- Low deposit amount – NRIs can open the account by depositing a minimal amount of just Rs. 25,000.

- Multiple deposits – Most of the financial institutions in India associate this advantage with the NRO account. Individuals can make several deposits with just a single cheque.

- Smooth renewal process – On maturity, the deposits are automatically renewed, hence reducing any hassle.

- Flexible tenor – When investing in a fixed deposit, NRI investors can opt for a tenor between 12 and 36 months as per their convenience.

- Clarity on investment – FD calculator is provided by major financial institutions which help in evaluating the returns in advance before indulging in any investment.

NRIs can conveniently manage their finances both in India and abroad with the help of NRO accounts, and earn the highest returns by investing in fixed deposit through them. They can make the most of their income earned in India, be it in the form of rent, pension or other types of dividends through an NRO account.

It enables them to earn higher returns through fixed deposit investments, thus incorporating smart investment strategies to enhance their savings. Senior citizen NRIs can further enjoy better returns with FD investments through NRO account.

2 Replies to “NRO Fixed Deposit – 6 Things to Keep in Mind”