Personal loans have gained popularity recently as an effective way of borrowing money. One can use this money for various personal reasons. Be it the consolidation of debt, the improvement of your home, or even the payment for a wedding. This form of a loan can help you get ahead of your short-term financial needs.

Nonetheless, the finest personal loans typically come with interest rates that are lower than what you would pay on a credit card. It is a better alternative to other sorts of high-interest consumer debt, such as payday loans. This is because personal loans are secured by the borrower’s property.

Personal Loan Pro is a lending platform that provides users with an easy and quick way to find a lender that helps them meet their financial needs. Personal Loan Pro is an excellent marketplace to acquire a personal loan due to the fact that they provide a straightforward procedure and a speedy decision-making period.

Contents

An Introduction to Personal Loan Pro

Personal Loan Pro is based in the US by combining conventional lenders, P2P lending networks, and tribal loans. Since then, they have expanded to provide personal loans to people with various forms of credit across the country.

It is not a lender but instead provides a platform for customers with excellent and bad credit to get the cheapest rates by receiving many offers from various banks or lenders. You can easily locate funding when you’re interested in borrowing thanks to Personal Loan Pro, a website that compares loans.

The website generates revenue from lenders, not borrowers. Thus utilizing it will not cost you anything. In addition, it works with a vast network of diverse loan lenders, so you’ll have several options to choose from. It allows more ease and feasibility for consumers.

Who Qualifies For a Personal Loan?

Personal Loan Pro gives you the opportunity to compare interest rates and terms offered by a number of different lenders without having a negative impact on your credit score or requiring a great deal of legwork on your part. Plus, you can also apply for a loan with a low credit score.

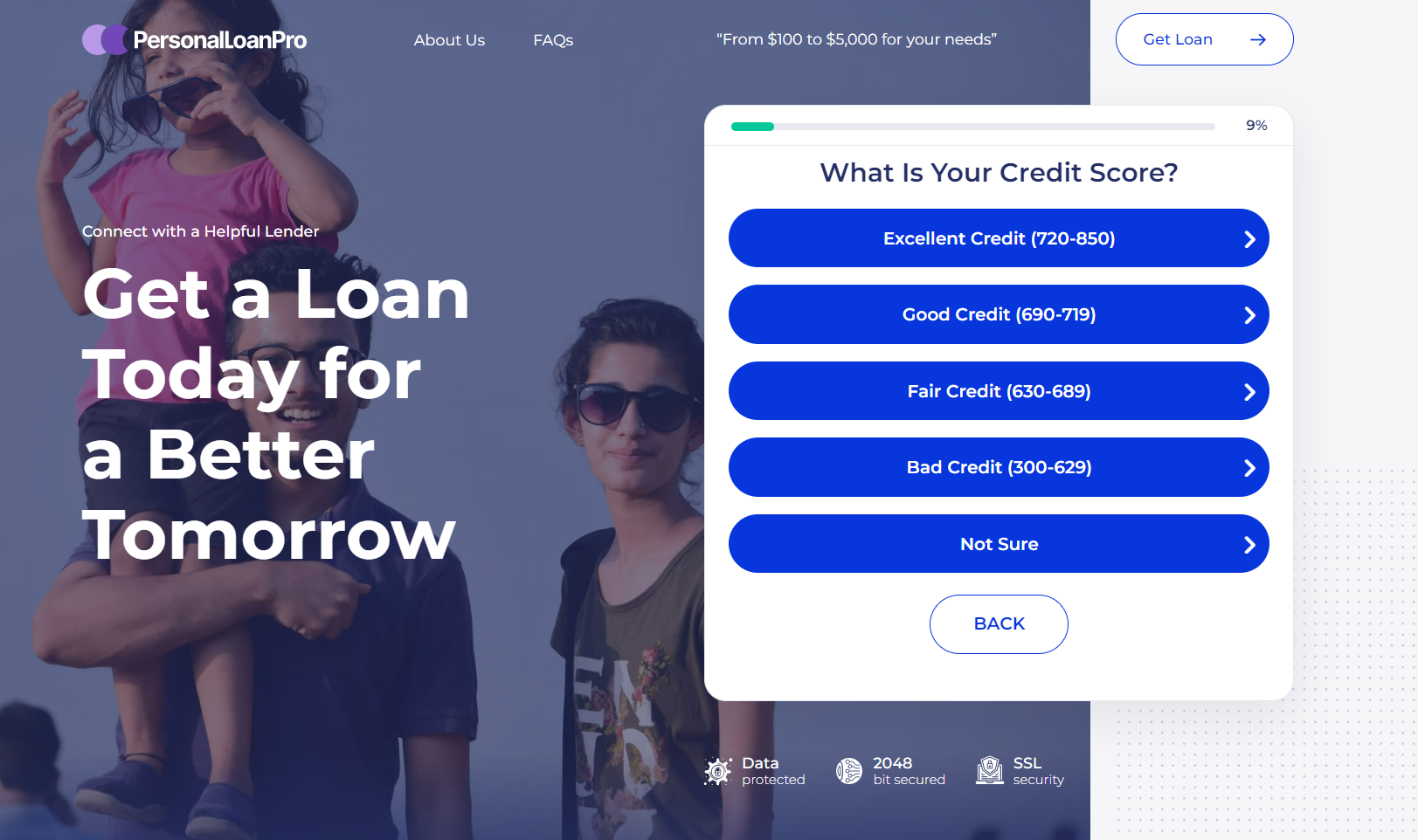

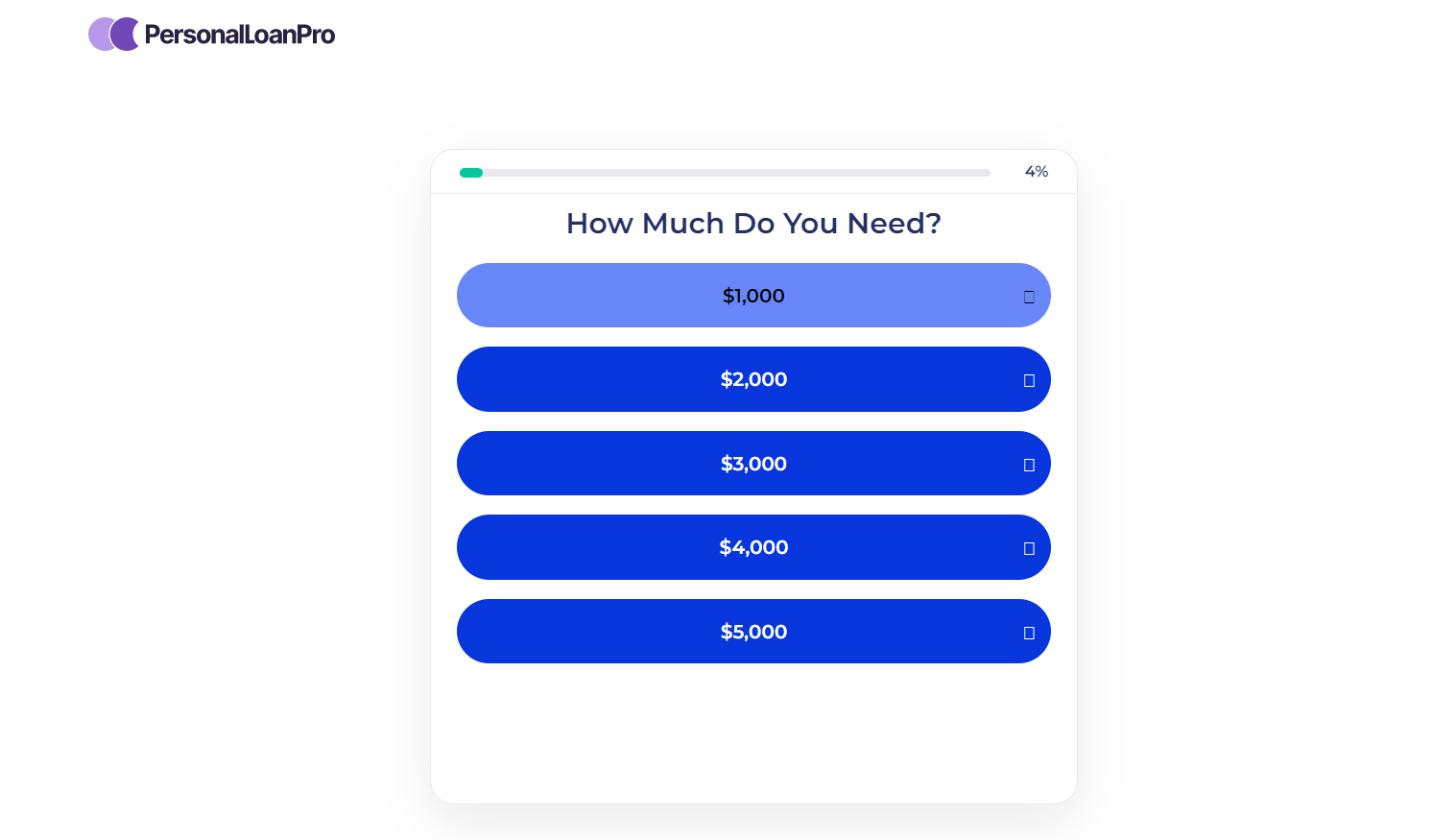

You just need to visit the website, choose the reason for acquiring the loan, and respond to some basic questions to be matched with loan providers that the website’s algorithm feels would be a suitable fit for you.

Your credit score, the amount of money you want to borrow, and the length of time you have to pay it back all play a role in determining the terms of the loan that will be made available to you.

- You must have held your current position for no less than 90 days.

- Have reached the age of 18 and are a citizen or permanent resident of the United States.

- Have a monthly income of around $1000 (after taxes have been subtracted).

- Your name should appear on the account.

- There must be a valid phone number listed for both your home and place of employment.

- Your valid email address.

The Application Process at Personal Loan Pro

During the application process, you will be asked to provide the following information:

- How do you intend to use the loan? Choose from debt consolidation, significant purchases, renovations to the property, credit card debt, major medical expenses, education, travel, and wedding costs, among other things;

- Employment status: full-time, part-time, self-employed, jobless, military, retired, and others;

- Yearly income plus pay frequency – weekly, bi-weekly, monthly, or other;

- Kind of residence – rented, owned, and other;

- Postal code, street address, email address, first and last name, date of birth, and telephone number;

- Are you a service member or veteran;

- A number of social security benefits.

- After entering the necessary data, all that is left to do is click the “Get my rate” option and wait for the system to provide you with an estimate based on your credit score and other pertinent variables.

Perks of Using Personal Loan Pro

Customized deals and promotions

PersonalLoans.com will analyze the one-of-a-kind information you provide and present you with the loan offer that is most suitable to your financial profile as well as your specific requirements.

Instant money

Clients have the opportunity to have cash deposited into their bank account as early as the following working day.

Numerous lenders

You will have access to several lenders and offers in one easy spot thanks to PersonalLoans.com’s role as a loan aggregator.

Drawbacks of Using Personal Loan Pro

Loan aggregator

If you are serious about pursuing a particular loan offer, you must continue the application procedure with the lender directly since PersonalLoans.com is not a direct lender.

Frequently Asked Questions (FAQs)

Is Personal Loan Pro Legal?

PersonalLoans.com has assisted thousands of consumers in obtaining loans for nearly two decades. It is a respected loan platform that ensures expert, secure transactions and has reliable partners. Personal Loan Pro has connections with reputable businesses, has a list of lenders it has collaborated with, and in its stated privacy policy, clearly outlines what it does with the information you give.

Will Personal Loan Pro Charge Extra Fees?

Personal Loan Pro’s service requires only a soft credit inquiry. Therefore, submitting an application will not have a negative impact on your credit score. If you decide that a loan’s terms are acceptable and you proceed with the application procedure, this will entail a credit check. If you have an excessive number of inquiries listed on your credit report, it could have a negative impact on your credit score.

Is It Possible to Get A Personal Loan with Bad Credit from This Platform?

It’s advisable to work on raising your credit score before acquiring more debt. Yet, you can still secure a personal loan with weak or poor credit. When evaluating a personal loan application, lenders frequently analyze your creditworthiness and debt-to-income ratio to make sure you can afford your monthly payments. If you want to enjoy lenient loan terms and rates, try improving your credit score.

Conclusion

With tons of experience, Personal Loan Pro has established itself as a consumer favorite, thanks to its user-friendly website, the automated and fast application process, and reliable network of lenders. In our review of Personal Loan Pro, we’ve discussed many of the reasons why this site is an excellent resource to acquire rapid loans from different lenders. However, one should always carry out a comparative analysis to opt for the most suitable service provider.