Contents

Overview

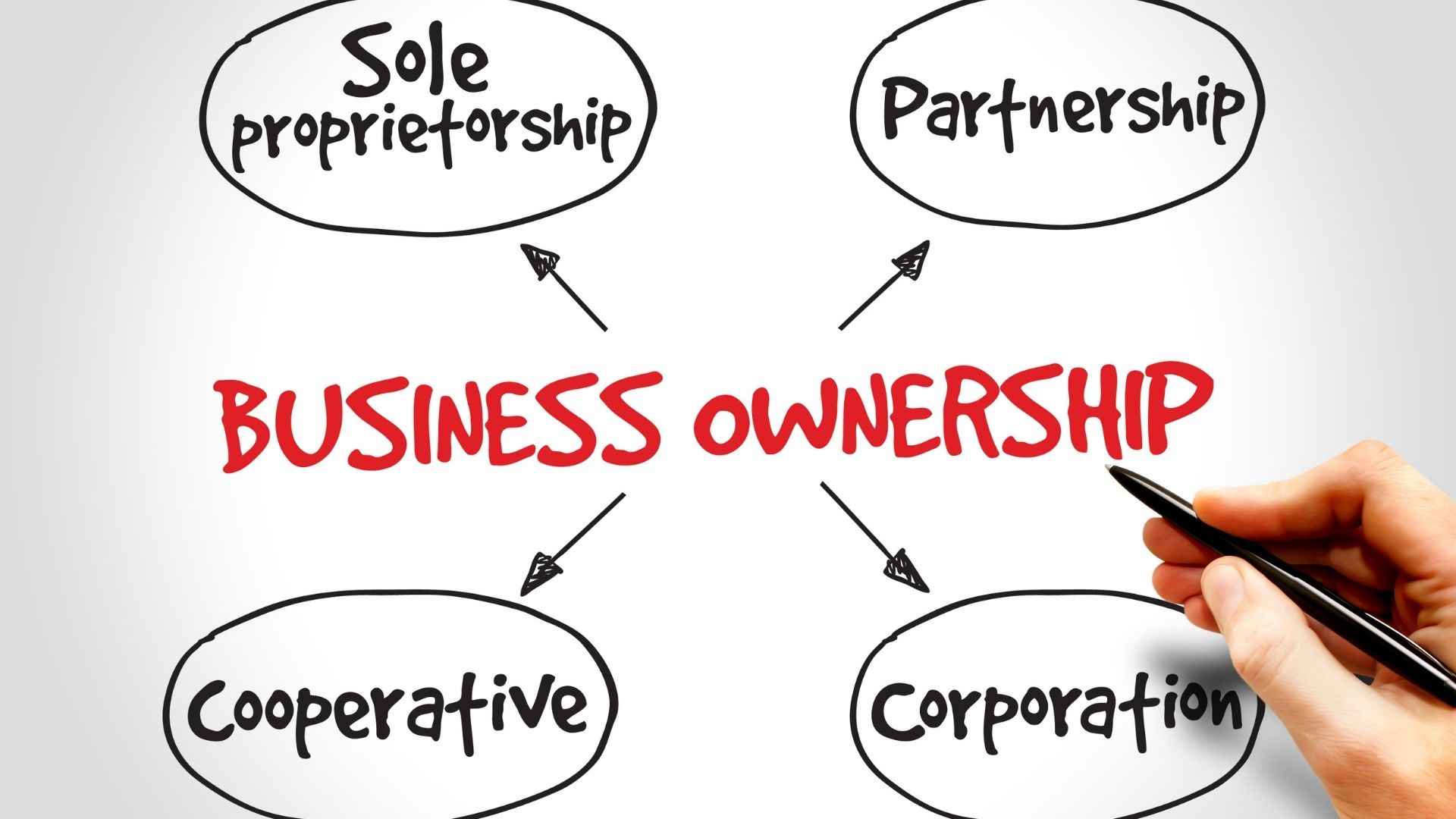

Be it a generation-old business or a new booming venture, taking a decision on business ownership would impact not only how the business works but also how decision-making happens, risk is divided and tax is computed.

Choosing the right business structure is essential as it can significantly affect the career path and trajectory of the business. In order to decide the type of business ownership that would be apt for a growing small business, it is crucial to consider the-

Types of Business Ownership for a Growing Small Business

- Level of control you want in the business.

- Total investment your business will require or is there a requirement of loan for your business, if any.

- Amount of liability or risk you can incur as an individual (100% or distributed).

- Level of compliance that would be apt for your business.

Liability & Personal risk

The activity and scale of your business are key components in calculating the level of risk any company or business faces. If you have opted for a partnership business ownership structure, then your liability and personal risk as an owner would be significantly reduced as it is divided amongst partners. Companies and LLP ownership structures also protect the liability of the owners, with a few exceptions.

Types of business ownerships for single business owners:

1. Proprietorship firm- It is an unorganized and informal structure

2. One Person Company (OPC)- This is a type of a private company

Types of business ownerships for multiple business owners:

1. Partnership firm- It’s an unorganized form of business

2. Limited Liability Partnership- This type of ownership is a combination of partnership and company

3. Private Limited Company- This is a separate legal entity with equity ownership

Advantages of having a Partnership firm:

– Profits are taxable only once

– Partners have complementary skills

– Liability protection with the separate legal status

– Relatively easy to establish

Disadvantages of having a Partnership firm:

– Profits are shared amongst partners.

– Partners would be individually and jointly liable for the actions of other partners.

– Decision-making rights and processes are divided.

– Lack of detailed partnership agreement could affect the business.

Depending on the type of ownership structure, you can then decide rights and responsibilities if it is being divided between partners accordingly.

In conclusion:

Different types of business ownership, be it a partnership firm or a sole proprietorship, will have their own merits and demerits. It is crucial to understand business needs, aim, mission and vision, to make the right decision. It also becomes easier to opt for capital infusion, pitch for funding, and apply for business loans as and when the business needs arise. Using a business loan calculator, you can quickly run the numbers and get an estimate of the interest you will incur at the decided rate of interest.

Ownership decisions in a growing small business will have a long-lasting impact on the business. Hence, it must be taken with caution and after consulting a lawyer and Chartered Accountant.