Everyone is hoping to retire one day. You see it in commercials all the time. Everyone is talking about retirement and people in their retirement being happy.

But you have to start planning for retirement as soon as you have an income. Putting money away for retirement shouldn’t be an ‘if’ statement. It should be a ‘when.’

If you have an interest in annuities, why not learn more about them and how annuities for retirement work? Want to learn more? Read on!

Contents

What Are Annuities?

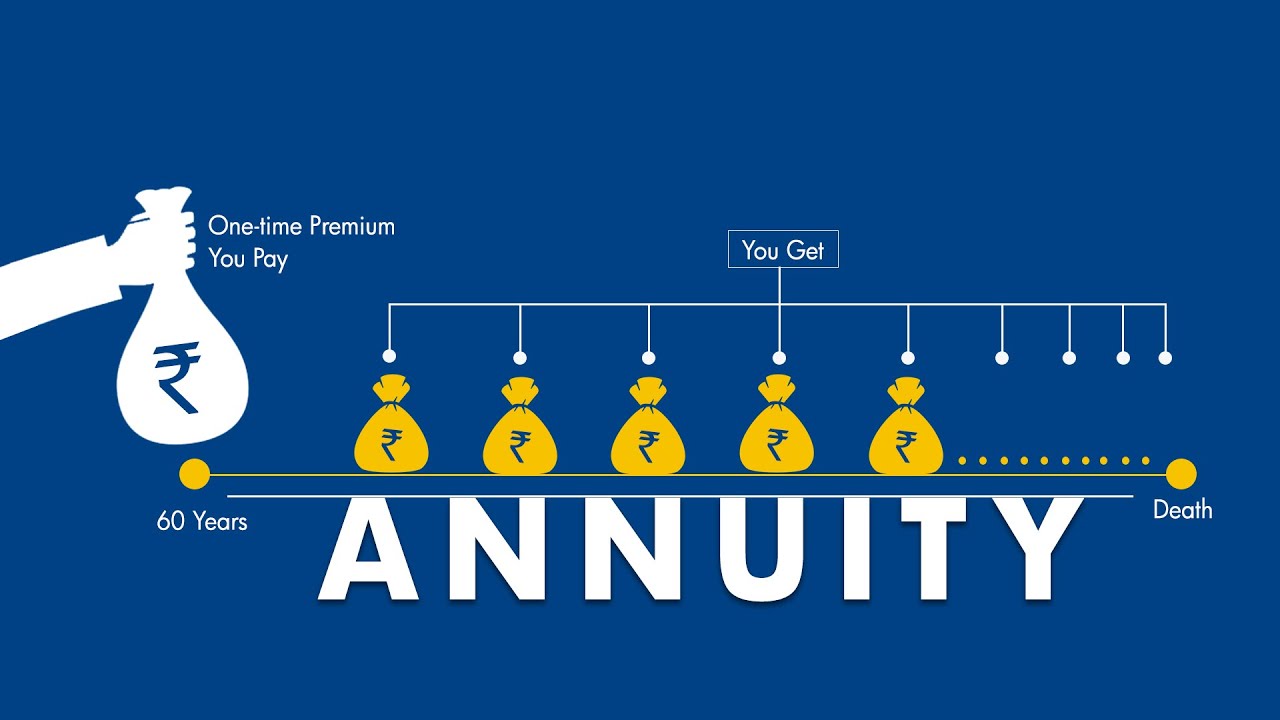

Annuities are a type of contract with a financial provider, such as a bank or insurance company. They allow individuals to purchase a benefit that pays out periodic income over time.

In exchange for purchasing an annuity, the individual is entitled to receive payments. It is usually monthly or annual, over a predetermined period of time.

Annuities are useful vehicles to help protect against outliving assets, and they can provide a steady stream of retirement income. It can also be used to transfer assets to the heirs of the original annuity owner.

It can be either fixed or variable, although the majority of it’s fixed. Fixed annuities ensure that the investor’s money will grow over time at a predetermined rate. While with a variable annuity, they invested the investor’s money in the financial markets and carried with it some degree of risk.

How Do They Work?

The individual pays a fixed amount of money or a series of payments. In return, the insurance company agrees to pay a fixed amount of money over an agreed period of time. It is also structured to provide income for a fixed period of years or for the remainder of the individual’s life.

The underlying mechanism of it is also based on two fundamental principles, compound interest and mortality assumptions. They will invest in every payment that’s made by individuals and earn interest over time.

While the mortality assumptions account for the expected lifespan of the individual, as the funds grow with the accumulation of interest, each payment provided by the insurance company to the individual is a blend of the invested principal and the corresponding interest associated with the funds.

Different Types of Annuities

Annuities are generally used as a retirement or tax deferral strategy but can be used for other purposes as well. There are several types of annuities that offer different levels of risk and return.

Fixed-Rate Annuity

It is a type of annuity that pays a fixed return rate over a set period of time. This type of annuity can be beneficial for those individuals who are seeking a steady and reliable income stream for their retirement years.

The rate of return is determined when the annuity contract is purchased, and the investor is guaranteed that the rate will not change for the duration of the contract.

Variable Annuities

A variable annuity is a type of annuity that allows the investor to allocate funds among a variety of different investment choices, or “sub-accounts.” This allows the investor to customize their portfolios to meet their individual goals and risk tolerances.

With variable annuities, investors also have the option of selecting a death benefit guarantee, which provides a fixed income stream to their beneficiaries in the event of their death.

Index Annuities

Index annuities are a type of annuity that offers periodic payments that depend on the stock market’s performance. The benefit comes from their ability to provide protection against market losses.

They allow the investor to control their risk and minimize their losses while still gaining some of the benefits associated with stock ownership. With index annuities, the investor does not have to worry about the day-to-day market movements and can still see good returns for their invested capital.

Immediate Annuities

Immediate annuities are contracts that individuals can purchase from insurance companies in order to gain a regular stream of income during retirement. These annuities are customizable, providing retirees with options to meet their individual needs.

The primary benefit of immediate annuities is the steady stream of income they provide, making financial planning during retirement simpler. The income they provide can also supplement other forms of retirement income, such as Social Security and pensions.

Deferred Annuities

A deferred annuity is a type of annuity that allows money to be deposited on a pre-determined schedule. Those who purchase a deferred annuity agree to postpone the payout of income until a later date, usually when the purchaser is retired.

This type of annuity allows the depositor to accrue interest tax-deferred until the money is withdrawn. Benefits of deferred annuities include the ability to increase savings steadily, the ability to defer tax goes until the funds are taken out, and the protection of the funds from market volatility.

Each of these types of annuities has various benefits, such as tax advantages and potential for apprec

Making the Right Choice

In order to make the right choice in annuities, it is important to understand the complexities of cash flow banking. As a fundamental part of creating a comfortable retirement plan, it can provide the security of a guaranteed interest flow that can outlast each individual.

By depositing money, individuals are able to create a stream of income. It will help their retirement plan remain secure and attainable. For individuals looking to secure a retirement income, it allows them to convert their lump sum of money into a steady stream of income, often for life.

For this reason, it is important to understand the different types of annuities before making a purchase. To ensure the right annuity plan’s chosen, it is necessary to determine when payments should begin, how long they should last, and the risk and reward benefits of each type of annuity.

With the help of a professional, an individual can choose the right annuity that best suits their particular needs and financial goals.

Learn More About Annuities Today

Annuities can help provide a reliable and regular way to receive income. By matching your goals with the right type of annuity, you can create a specific plan that best fits your individual needs.

Speak with a financial professional to determine which annuity is best for you and start planning for a more secure financial future.

Did you find this article helpful? Visit more of our blogs!