When it comes to financing, personal loans are probably the most flexible and preferred financing tool. These loans come with many attractive features, can be used for diverse purposes and are very easy to manage. Today, you can easily avail of a personal loan through a loan app. But before opting for a personal loan, you must know the difference between secured personal loans and unsecured personal loans.

Most personal loan apps offer you easy unsecured personal loans. You just need to meet the eligibility criteria to avail of an instant personal loan. You can approach a bank or an NBFC for secured personal loans.

Read to know more about secured personal loans and unsecured personal loans and which one is a better fit for you.

Contents

Secured and unsecured personal loans

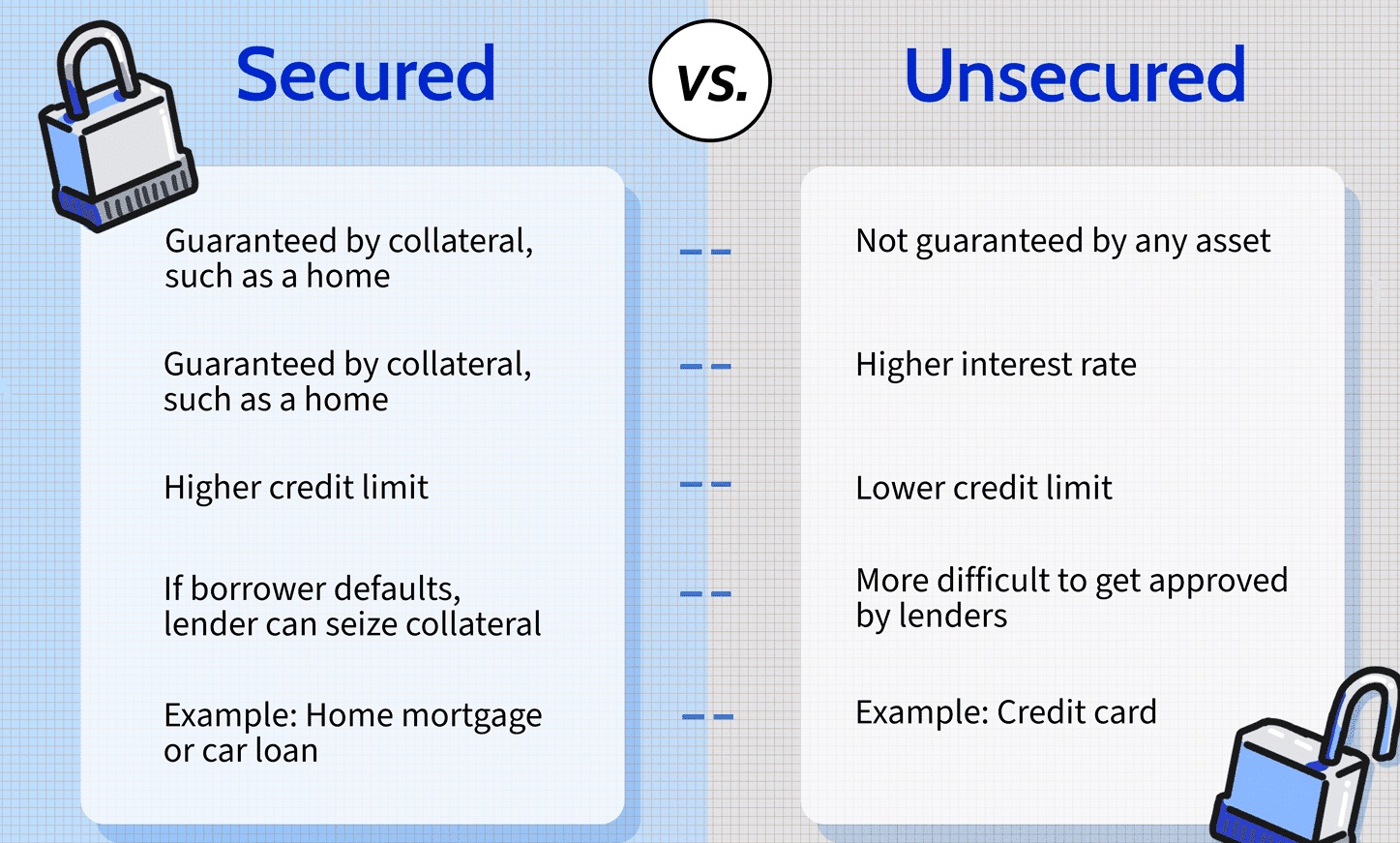

Personal loans are inherently unsecured. This means it is not necessary to submit any collateral or guarantee to avail of a personal loan. However, the interest rate for such loans might be a bit high. Also, you must have a good credit score to be eligible for a personal loan. In case, your credit score is not that high or you don’t meet the eligibility requirements cited by the lender, then you can go for a secured personal loan.

In a secured personal loan, you pledge your assets or investments against the loan. In case, you fail to repay the loan, the lender can cease your assets or investments. Thus, their risk of losing money is significantly reduced. As such, they are more open to offering you the loan amount at better loan terms. You might get a secured personal loan at a reduced interest rate or zero processing fees. However, you must have an asset of an equivalent amount or higher value to pledge to get the loan.

Understanding Secured Personal Loan

A secured personal loan is collateral-based funding. To avail of a secured personal loan, you can choose from a wide range of personal assets to provide as collateral. For instance, you can use your house property, land, rented property, gold, vehicle, or any such high-value asset as collateral to avail of the loan. You can also avail of a personal loan against your FD or shares.

What is an Unsecured Personal Loan?

An unsecured personal loan is a financing option that is provided to borrowers without any asset as collateral security. To avail of this loan, a borrower needs to meet a set of eligibility criteria and documentation requirements as laid down by the lender. While the criteria are minimal, it is essential to meet all of them as it would impact the chances of approval.

When availing of the advance through a personal loan app, you can readily check the criteria set by your lender and proceed to apply for the financing accordingly.

Differences between a Secured and an Unsecured Personal Loan

1. Collateral requirement

The first and most basic difference between secured and unsecured personal loans is that of collateral requirement. If you opt for a secured personal loan, then you must make sure you have something to pledge. It should be in your name. You can either pledge your assets or investments. But in the case of unsecured loans, you do not need to worry about collateral or assets.

2. Risk to personal asset

Since a secured personal loan is tied to the asset provided as collateral, it also creates a risk to the personal asset for the borrower. Contrarily, an unsecured personal loan relieves the borrower of any such risks. Personal loan apps serve best if you are looking for small-ticket unsecured personal loans.

3. Time taken for approvals

Secured personal loans require extensive verifications of the asset that you are submitting. As such, the time taken for its approval can be long. As against that, unsecured personal loans are quickly approved as the lender only needs to assess the borrower’s income and credit profile. When you apply for an unsecured loan through a personal loan app, you get the loan amount within hours.

4. Consequence of non-repayment

In case the borrower defaults on a secured personal loan repayment, the lender reserves the right to recover the loan liability through an auction of the asset. Contrarily, the lender does not have any such rights on the borrower’s personal assets for unsecured personal loans. However, a non-repayment of this loan creates a negative impact on the credit profile of the borrower.

Conclusion

Both secured and unsecured personal loans have their own pros and cons. If you have an asset to pledge and you are sure of your repayment plan then you can go for secured personal loans. But most youngsters opting for quick financing do not have an asset to pledge. As such an unsecured personal loan can serve you well. You can simply download a loan app and apply for a loan in minutes. It is also quick and hassle-free.