The need for AI-based cloud services will only increase, according to Gartner. Businesses are developing many software products, but some will never surpass the MVP stage. Cloud service providers reach big and small businesses by analyzing data and enabling low-skill users (or those on a tight budget). The AI will take the next move.

With the help of AI, enterprises will manage infrastructure, electricity consumption, cooling systems, network management, and other essential tasks. How does this market development affect banking? What’s the place of AI in financial services?

Contents

Сloud Computing: a Catalyst for Digital Transformation

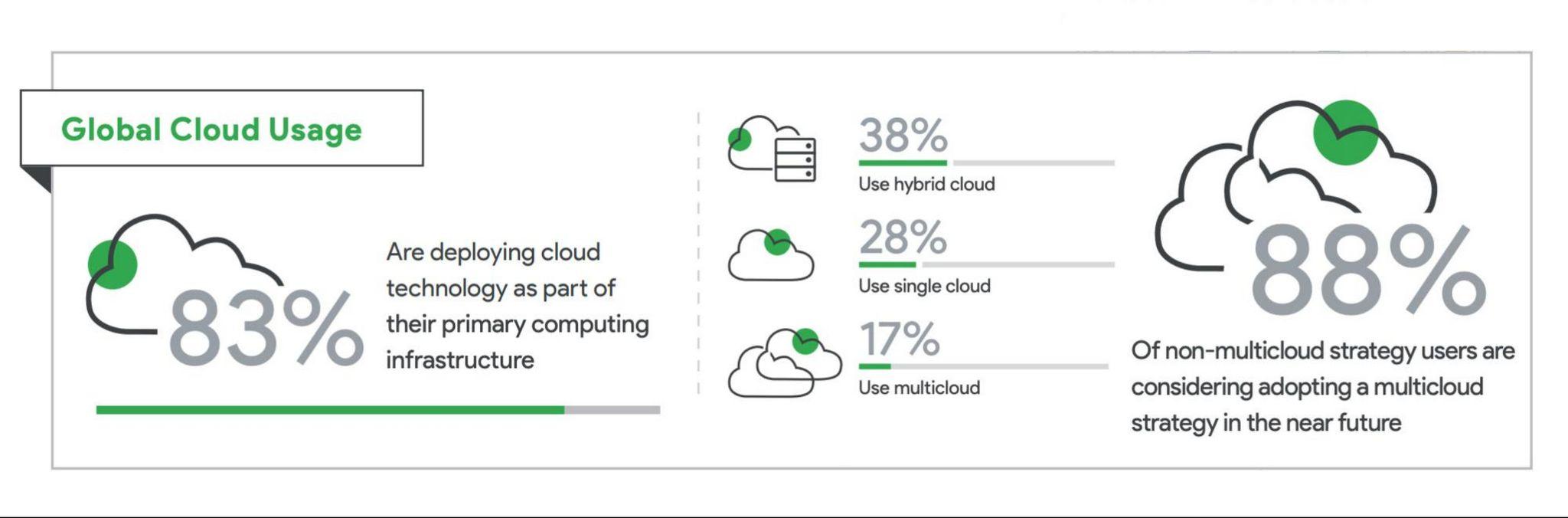

In a rapidly digitalizing world, organizations are under pressure to transform in order to remain competitive. Cloud computing is often seen as a key enabler of digital transformation, as it provides the agility and flexibility needed to quickly scale services and applications. Additionally, it can help to improve organizational efficiencies and reduce costs. For these reasons, many businesses are turning to cloud computing in order to drive their digital transformation initiatives. In the Google Cloud research, 83% of the businesses polled stated they use cloud computing as the mainstay of their IT systems.

Cloud computing has become the standard for delivering computing as a service. It allows users to access software without worrying about maintaining and operating the hardware needed to run a data center. This has many benefits: it is much cheaper than running everything in-house, which allows for greater access by customers; it is scalable, which allows for more users to use the service; it is more convenient than running a data center in-house; finally, it has lower up-front costs than buying and maintaining the hardware needed to run a data center.

Perhaps most importantly, though, it enables businesses to better utilize data and analytics. With the help of cloud computing, businesses can gain insights into customer behavior, optimize operations, and make better decisions. By enabling organizations to store and access data on remote servers, cloud computing provides a flexible and cost-effective way to manage information. In addition, cloud-based applications can be quickly deployed and scaled up or down as needed, providing businesses with the agility they need to compete in today’s fast-paced marketplace.

How Does Cloud Computing Affect Fintech?

Edge computing and app development work hand in hand when it comes to technologies specifically for the financial services sector. While most of the computational capacity remains in the cloud, banks and financial institutions are interested in creating apps that bring critical data closer to their end customers. According to Neil Gallagher of Fintech Futures, banks that want to remain competitive will invest in IT infrastructure that offers connection options worldwide, enhancing client experiences in both urban and rural areas.

The role of cloud computing in the financial sector is expanding. Its use is proven time and time again to reduce costs, increase storage capabilities, and enable remote work. The financial services industry is also finding that cloud-powered AI generates real-time insights into the stock market, offering timely and useful advice to their clients through customer support bots.

Cloud computing technology can be useful in enhancing security for financial transactions if used correctly. Financial institutions recognize the expertise that these services have to offer in combating new cyber security threats and are now increasingly incorporating cloud computing into their IT infrastructure simply to protect the security of their clients and investments (even though it means having to make changes in their existing compliance policies).

Cloud-Powered AI for Banks

One of the biggest challenges in banking today is the complex systems required to deliver a personalized customer experience. The technology required to build these systems is expensive and time-consuming to build and operate, which limits the number of services offered by banks to their customers. The ability to build systems that understand and respond to individual needs and preferences, rather than a list of predefined actions, will transform how customers interact with traditional banking services. The first step in this journey is to build cloud-based platforms that can support the training of complex AI models.

Cloud computing has become an integral part of banking, allowing banks to run complex software and services without worrying about managing the physical infrastructure needed to run a data center in-house. This has allowed banks to use software and services that were not feasible to run in-house, such as AI-powered chatbots. This has improved the customer experience and provided banks with additional income opportunities, unlocking new insights and capabilities to help banks meet their customers’ needs.

The Advantages of Cloud-Based AI in Banking

The basic idea of cloud computing is to provide computing as a utility, similar to electricity or water, where the consumer pays only for what he or she actually uses. Hence derive its many benefits. Cloud computing provides a number of advantages over traditional on-premises IT infrastructure, including increased flexibility, scalability, and cost-efficiency. By moving to the cloud, businesses can free up valuable IT resources, allowing them to focus on more strategic initiatives. In addition, cloud computing enables businesses to respond to changing market conditions and customer needs quickly.

Some other advantages include:

- Natural language processing powers bots and chatbots to answer simple questions and provide simple, actionable answers. It also can enhance the services that customers can access over the web.

- Allows users to use software and services without owning them, instead renting those services from a virtual data center provider.

- Provides context-sensitive recommendations and generates insightful reports, which has the potential to enhance the services that customers can access over the web, rather than just on a desktop or mobile app.

- Enhances the services customers can access over the web, rather than requiring them to interact with a human customer service agent.

However, it is important to note that cloud computing is not a silver bullet solution. Organizations need to clearly understand their needs and requirements to effectively leverage the power of the cloud. Additionally, they need to ensure they have the right capabilities to manage and operate their services and applications.